Introduction to Fungible Tokens

The world of cryptocurrencies is full of unique terms and concepts that may seem a bit confusing at first glance. One such term is “fungible token.” A fungible token is a type of digital asset built on blockchain technology, such as Ethereum or Bitcoin.

These tokens are considered ‘fungible’ because they are identical or uniform to each other and can be exchanged on a one-for-one basis. A fungible token is a type of cryptocurrency that functions similarly to traditional currencies like the US Dollar or Euro. Each token is equivalent in value and function, making them ideal for use as a medium of exchange or a store of value.

The most popular type of fungible token is ERC-20, a standard primarily used for creating and issuing smart contract tokens on the Ethereum blockchain. Other blockchains also support the creation of fungible tokens, including the Binance Smart Chain (BEP-20 tokens) and Tron (TRC-20 tokens).

Exploring Non-Fungible Tokens

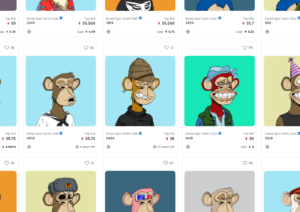

Non-fungible tokens, often referred to as NFTs, are a type of digital asset that has gained significant attention due to their unique properties. Unlike fungible tokens, NFTs are not interchangeable on a one-for-one basis. Each non-fungible token is unique and contains specific information or attributes that distinguish it from other tokens.

Non-fungible tokens have found widespread application in the world of digital art, collectibles, and virtual real estate. They are typically built using the ERC-721 standard on the Ethereum blockchain, although other blockchains like Binance Smart Chain and Flow also support the creation of NFTs.

Understanding the Difference between Fungible Tokens and Non-Fungible Tokens

While both fungible tokens and non-fungible tokens are forms of digital assets built on blockchain technology, they have several key differences.

The primary difference between a fungible token and a non-fungible token lies in their interchangeability. Fungible tokens are uniform and interchangeable. For example, if you lend someone a Bitcoin, it does not matter if they do not return the exact same Bitcoin because all Bitcoins are identical in value and function.

On the other hand, non-fungible tokens are unique and not interchangeable. If you lend someone a specific NFT, they must return that exact NFT because no other token will have the same attributes or value.

The Value of Fungible Tokens

The value of fungible tokens lies in their uniformity and interchangeability, making them ideal for use as a medium of exchange or a store of value within the crypto ecosystem.

Fungible tokens also underpin the operation of Decentralized Finance (DeFi) applications. DeFi platforms often use fungible tokens as collateral for lending and borrowing, for liquidity provision, or as governance tokens that give holders a say in the platform’s operation and development.

The Value of Non-Fungible Tokens

The value of non-fungible tokens lies in their uniqueness and the ability to prove ownership of a digital asset. The rise of NFTs has enabled artists and creators to monetize their work in ways that were not previously possible.

By tokenizing their work as an NFT, creators can sell it directly to consumers without the need for a middleman. Owners of NFTs can prove their ownership and also enjoy the potential of their asset appreciating in value over time.

Use Cases of Fungible Tokens

Fungible tokens have a wide range of uses within the crypto ecosystem. They can be used as a medium of exchange, a store of value, or a unit of account. Cryptocurrencies like Bitcoin (BTC) and Ether (ETH) are examples of fungible tokens used in this way.

Further, DeFi platforms use fungible tokens as collateral for lending and borrowing, for providing liquidity in automated market makers, or as governance tokens.

Use Cases of Non-Fungible Tokens

Non-fungible tokens have opened up new possibilities for digital ownership and monetization. Their primary use is in the realm of digital art and collectibles. Examples include digital artwork, virtual real estate, virtual goods in video games, and even tokenized versions of physical assets.

Conclusion

Understanding the difference between fungible tokens and non-fungible tokens is key to navigating the diverse landscape of digital assets. Whether it’s the interchangeability of fungible tokens or the uniqueness of non-fungible tokens, both have their unique value and use cases in the evolving world of blockchain technology and cryptocurrencies.